35+ 30 year mortgage payment calculator

The maximum amortization is 25 years for down payments under 20 and 35 years for higher down payments. The most common mortgage terms are 30 years and 15 years in the United States.

400 Regular Verbs List In English Grammarsimple Com In 2022 How To Memorize Things Verbs List Regular Verbs

In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which.

. Use our calculator above. This calculator makes it easy to compare the monthly payments for any. To estimate your break-even point more easily you can use the above calculator.

In the Advanced Settings section you can update the property taxes and insurance estimates for your specific location though 12 and 035 are typical. Historical 15-YR 30-YR Mortgage Rates. Please select a payment frequency.

This calculator will also figure your total monthly mortgage payment which will include your property tax property insurance and PMI payments. You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options. A 15-year fixed-rate mortgage has a higher monthly payment because youre paying off the loan over 15 years instead of 30 years but you can save thousands in interest over the life of the loan.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. In the beginning most of your monthly payment goes towards paying. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR.

65897 66. Mortgage default insurance - also called CMHC insurance - must be purchased for down. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

To use the VA loan calculator adjust the inputs to fit your unique homebuying or refinancing situation. As of September 8 2022 the average 5-year fixed mortgage rate available from the Big 5 Banks is 532. Evaluate your total housing payments eg.

The maximum amortization is 25 years for down payments under 20 and 35 years for higher down payments. The following table compares the cost of making no down payment a 3 down and a 5 down on your loan. Lenders charge a higher interest rate precisely because payments are spread out for 30 years.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Using our calculator on top lets estimate mortgage payments with the following example. As of September 8 2022 the best high-ratio 5-year fixed mortgage rate in Canada is 429.

These other expenses can make up to 13 of the typical monthly expense on a 30-year mortgage so paying off a specified amount of debt in 15 years rather than 30 years may only represent a 30 to 35 larger total monthly payment. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association. If you want to make an extra payment each month to pay off your mortgage use the mortgage payoff calculator extra payment.

The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can qualify for. Over 20-30 years the savings can be substantial in the tens of thousands of dollars.

The calculator updates your estimated VA loan payment as you change the fields. The repayment period must be a minimum of 1 year and a maximum of 30 years. On a 30-year fixed-rate mortgage the payment is divided up by monthly payments where a borrower will pay the same amount each month for 30 years.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Secure a great mortgage rate and lock in your monthly mortgage payment now. Borrowers will be paying a lot more money in interest with a 30-year term than a 15-year term mortgage.

This allows you to secure a lower rate and pay your mortgage earlier. Use our Ontario mortgage calculator to determine your monthly mortgage payment for your home purchase in Ontario. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

Rates are influenced by the economy your credit score and loan type. Conforming loans have a price limit set annually with high-cost areas capped at 150 of the base cap. Most homebuyers choose the 30-year fixed loan structure.

Lets take a look at an example of how much more a borrower will pay at the end of a 30-year term compared to the 15-year term. Use our BC mortgage calculator to determine your monthly mortgage payment for your home purchase in BC. There are options to include extra payments or annual percentage increases of common mortgage-related expenses.

Dont forget property taxes and utilities ideally keeping them at 35. The limit for single family homes in 2022 is 647200. Lets say you took a 30-year fixed USDA loan worth 250000 at 3 APR.

The average mortgage interest rate is around 55 for a 30-year fixed mortgage. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly.

Compare 15 30 Year Fixed Rate Mortgages. 30-Year Fixed-Rate USDA Loan. Mortgage default insurance - also called CMHC insurance - must be purchased for down payments.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. However if it takes a long time to reach your break-even point say 10-15 years you have to ask yourself whether the small savings youll realize each month are. 30-Year Fixed-Rate Mortgage Loan Amount.

If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. 30-Year Fixed-Rate Mortgage Loan Amount.

For example lets compare interest costs between a 30-year fixed mortgage and 15-year fixed mortgage with a lower. Use the Mortgage Payment Calculator to discover the estimated amount of your monthly. Refer to this example to help you understand the basics of how different points affects the overall cost of a mortgage.

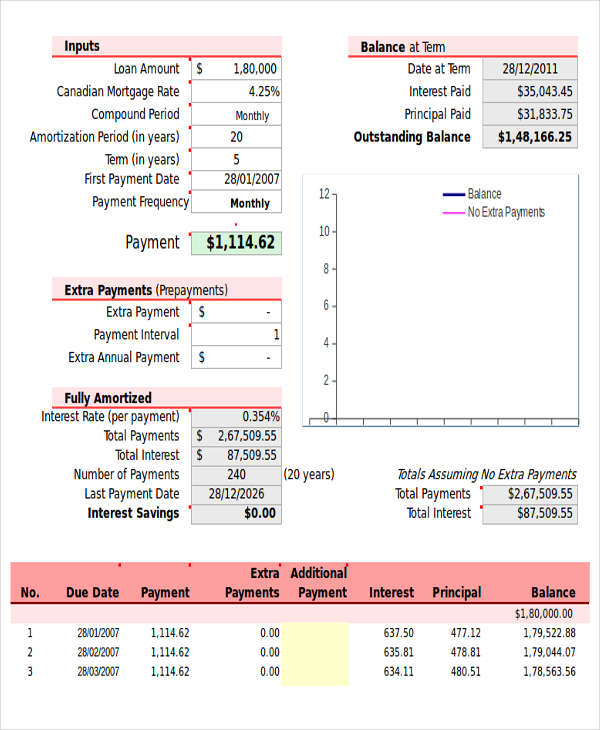

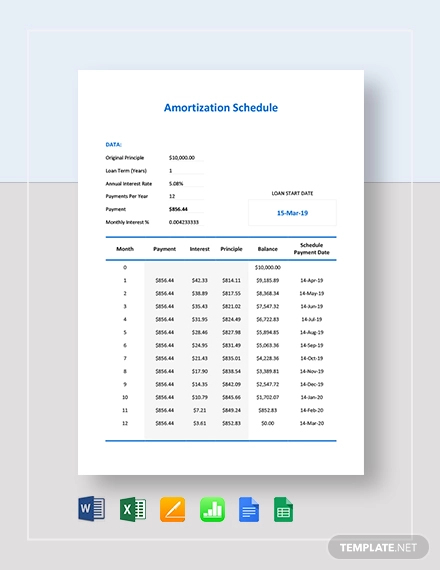

If you can afford it consider taking a 15-year mortgage over a 30-year term. Due to the longer payment duration interest rates in a 30-year mortgage are often higher. Need a sample amortization schedule for a 30-year fixed mortgage.

We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side. This rate is also available across Canada in Ontario Quebec British Columbia and Alberta. You will get a comparison table that compares your original mortgage with the early payoff.

Kenya Silver Ceramic Wall Tile 8 X 24 In Banheiros Pequenos Modernos Banheiro Pequeno Casas

29 Amortization Schedule Templates Free Premium Templates

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

35 Bike Storage Ideas For Small Apartments Diy Bike Rack Bike Storage Solutions Bike Storage

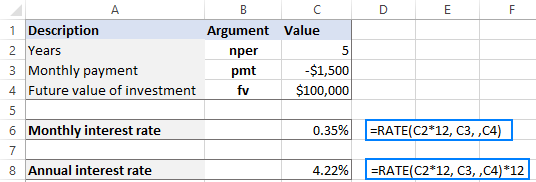

Using Rate Function In Excel To Calculate Interest Rate

45 Best Startup Budget Templates Free Business Legal Templates

Deck Designs Ideas Pictures Small Backyard Decks Deck Designs Backyard Patio Design

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

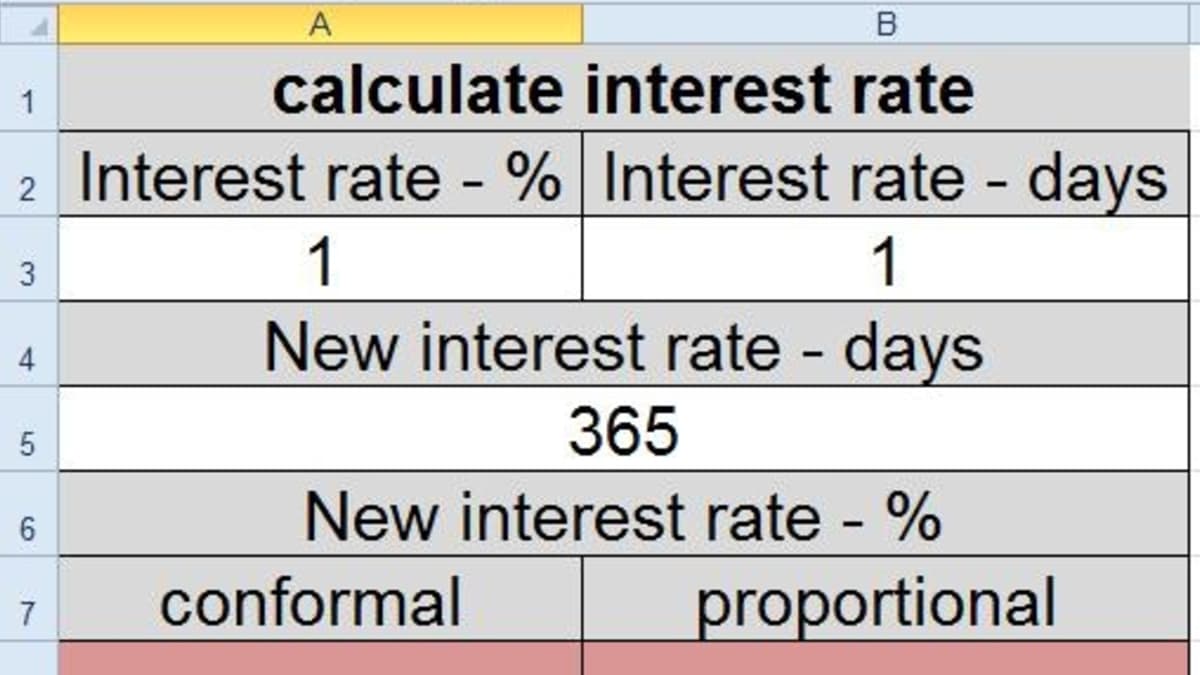

How To Convert Interest Rate Hubpages

Weekly College Schedule Template Luxury College Schedule Template Hourly Printable Daily Then College Schedule Schedule Template Daily Schedule Template

29 Amortization Schedule Templates Free Premium Templates

Detached Garage Ideas Top Detached Garage Designs Gambrick Detached Garage Designs Modern Farmhouse Exterior Farmhouse Style House

Setyouroom Com Nbspsetyouroom Resources And Information Backyard Spaces Backyard Play Backyard Playground

Creativemubarak I Will Do Professional And Creative Brochure Flyer Design For 10 On Fiverr Com Real Estate Flyer Template Flyer Real Estate Flyers

How Much Should You Spend On That Life And My Finances

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So